This white paper delves into the process of effectively estimating the size of immature markets and deciding on a reasonable market share that an actor has the potential to capture. Understanding the mechanisms to assess and approximate the dimensions becomes not only a pursuit of opportunity but a necessity for decision-making in M&A contexts and in formulation of company strategies.

Market sizing - Estimating the size of early-stage markets and company share of target market

The allure and potential of early-stage markets

The allure and potential of markets being in their infancy are undeniable. However, often representing multiple challenges, particularly when it comes to estimating total addressable market size (TAM) and near-term growth potential. The volatility, lack of historical data, and rapidly evolving nature of immature markets pose hurdles for understanding and capitalizing on potential.

Triangulation

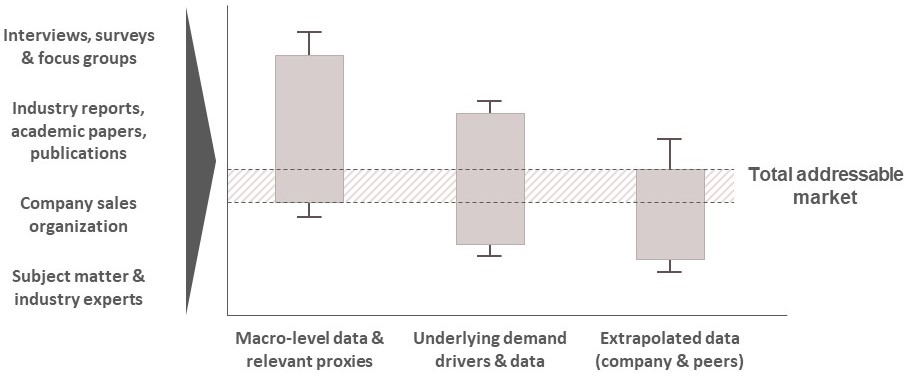

Using several data sources and a combination of analyses to estimate total addressable market size is an efficient methodology to derive a more accurate final projection, especially when a market is in its infancy. Triangulation could be conducted according to the following principles: 1) Multiple Data Sources, 2) Quantitative Analysis and 3) Qualitative Analysis.

1. Multiple Data Sources

Primary research: Interviews, surveys and focus groups can be used to gather first-hand insights from existing, lost, churned and prospective customers and key stakeholders in the Sales organization

Secondary research: Industry reports, academic papers, government publications and market analysis can be used to collate existing data and trends

2. Quantitative Analysis

Top-Down Approach: Using macro-level data and relevant proxies can be used to estimate total addressable market. Starting with an estimate of the total market size based on large-scale data (e.g., industry reports, government statistics) in combination with proxies, and then segmenting it down to the specific market

Bottom-Up Approach: Aggregating data from underlying demand drivers and relevant proxies, e.g. from individual units or smaller segments and then extrapolating this data serves as a method to estimate the total addressable market size

3. Qualitative Assessment

Expert Opinions: Leveraging insights from interviewing subject matter and industry experts can be used to supplement quantitative data and validate assumptions

Market Dynamics: Considering qualitative factors like consumer behavior, regulatory changes, and technological advancements that impact market growth will further assist in adjusting market size estimations

Illustration 1: Total addressable market triangulation

Finding the right proxy

For some analysis, using a proxy will be a critical step to understand and quantify the market potential. In situations where direct data is scarce or unreliable, proxies serve as substitutes, offering a means to estimate market size by leveraging analogous or related data sets. To identify an effective proxy, three dimensions should be considered 1) Relevance and Similarity, 2) Correlation and Accuracy and 3) Availability and Accessibility.

- Relevance and Similarity: The ideal proxy mirrors the characteristics, behaviour, or drivers of the target market. Look for sectors or markets that share analogous dynamics, consumer behaviours, or technological landscapes

- Correlation and Accuracy: Seek proxies that exhibit a strong correlation with the target market. Analyze historical trends and patterns to validate the relationship and ensure the proxy reliably reflects changes in the immature market

- Availability and Accessibility: Opt for proxies with accessible, reliable, and up-to-date data. Consider sources that offer transparency and consistency in their metric

Arriving at a reasonable projection

Only in some estimates, limitations that affect size of addressable market will become evident. This stresses the point to use different angles and metrics to arrive at the final market size conclusion. Weighing in the different methods from triangulation – it is more likely that the actual market size is in the lower range of the span, rather than the higher.

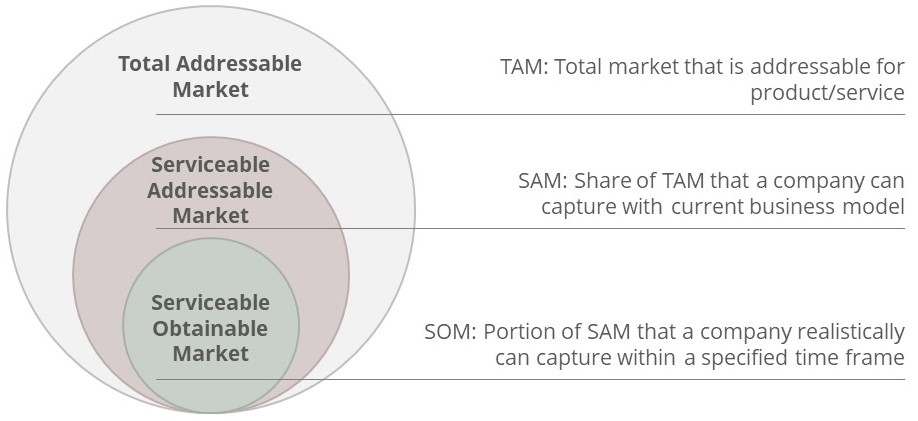

From the TAM it is then possible to narrow down market size estimation to the serviceable addressable market (SAM), see Illustration 2. SAM is the share of the TAM that a company can reach with its current business model. It focuses on the market segments that are in line with company positioning, capabilities and resources.

As for the estimated market share of the total addressable market that an actor can capture, serviceable obtainable market (SOM), it’s imperative to consider customer benefits, company capabilities and competitive landscape. Internal input such as company current market penetration, sales force and delivery capacity, historical win/loss data along with external factors such as competitive situation, customer maturity and other market dynamics should be considered to arrive at a reasonable projection.

Illustration 2: TAM break-down to SAM and SOM

Final remarks

Finally, it is worth emphasizing that all market size estimations inherit uncertainties and limitations. This is especially true for the attractive early-stage markets.

Axholmen has 15 years with extensive strategy development experience from projects delivered worldwide in multiple industries

Read more about how we can help your company

Contact us

20 years experience from creating P&L results through spend reduction, efficiency improvements, operating model revisions, re-design & dimensioning of organizations, working capital efficiency improvements and pricing optimization in large- and medium-sized companies in a diverse blend of industries, both in consulting and line responsible roles.

Erik Mokvist, Partner

+46 70 749 14 95

About Axholmen

Axholmen in short

Axholmen was founded in 2007 with the idea of providing a modern Swedish alternative to the global management consultancy firms. We are focused on profitability improvements that are delivered in close cooperation with our clients and with pragmatism as a core value

What we do

We have succeeded in building a large client base among leading Swedish, Scandinavian and Global companies as well as attracting and retaining top talent. We have accomplished this by delivering concrete results in strategic projects combined with a way of working in smaller, more senior teams, together with our client. Our clients describe us as both strategic and concrete by stating our ability to help them in finding the right solution to their most complex challenges and ensure that the solution is implemented and results are achieved

Who we are

Axholmen has a strong team of experienced management consultants that all share the idea that modern consulting services are justified by the actual results and financial value created. We are willing to share the commercial risk and tie a large portion of our fees to that the agreed results are achieved

Read our Whitepapers

Price optimization – Seven success factors that improve the acceptance rate for pricing adjustments

For many companies, a majority of revenue comes from the existing customer base in the form of ongoing agreements or new business from existing customers. Price adjustments or a transition to a new commercial model can be very important value adders – we share seven success factors that we believe affect the level of acceptance to a high degree regardless of industry and geography

Read more

Pricing – Immediate effect with limited risk

With the right pricing, you get immediate effect with limited business risk

Read moreFeel free to contact us for more information or to book an unconditional meeting